Unlock the Secrets to Saving Big on Your Next Hotel

Saving money is always important when traveling with your family or work. From the travel expenses to shopping, determining how much to spend will play a big part in the journey. Unless you’re staying with friends and family, a key component of your expenses will be where you’ll sleep.

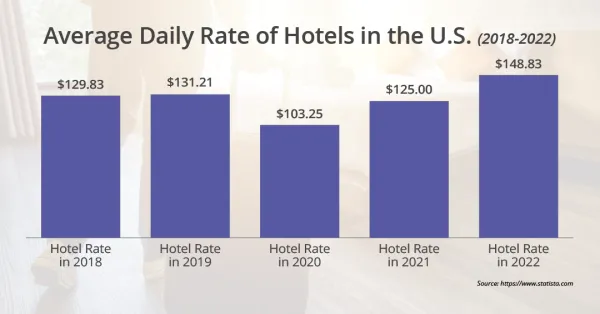

Hotels prices can vary depending on when you travel, so being prepared ahead of time may save you money. Here are some stress-free tips to help lower hotel expenses.

Stick to Your Budget

Your budget determines where you can afford to visit and for how long. Along with hotel costs, think about other expenses for your trip to set your budget:

- Airfare, baggage fees, car rental, parking

- Food and drink

- Shopping and gifts

- Travel prep expenses like vaccinations and passports

Your tentative budget should include how much you want to spend on your hotel and your desired amenities. A hotel room rate may vary depending on location, demand, and time of the year. They may also vary by room size and other perks such as complimentary Wi-Fi, and room service. You’ll want to find the comforts and conveniences that fit your budget. You may consider some of these money-saving options:

- Choose a less luxurious place if you plan to splurge on pricy activities and restaurants. You may rethink the trip duration if you don’t want to stay in a budget hotel or cheap accommodations.

- If you’re not planning to stay in your room for most of the vacation, consider saving some money on the size of the room or upgrades.

- Mini bars can be expensive. Consider bringing your own drinks and snacks.

- Save money by taking advantage of the hotel’s amenities, such as complimentary breakfast, the pool, game room, and fitness center. Some hotels may offer shuttle service to your destination at no cost instead of using taxis and public transportation. You may also consider walking if you're close by.

- Learn more about hidden fees and costs before booking. For instance, hotels may charge for parking, Internet usage, and more.

Hotels aren’t your only option – think about other inexpensive accommodations depending on where you plan to travel. You may find a good deal with some reputable alternatives:

A comfortable space doesn’t mean you have to break the bank. Research, comparison shopping, and creativity will guide you to the right money-saving location.

Rewards and Discounts

Most major hotel chains such as Hilton, Hyatt, and Marriott offer loyalty or reward programs. You may earn benefits by signing up, and as you use it, you’ll earn more rewards. After completing several stays or earning points for purchases, you may cash in for a free night and extra perks. Also, hotels may offer discounts when booking through them instead of a third party to entice people to book directly.

You may want to check if your credit card rewards program offers discounts on hotels and other incentives. Some programs partner with airlines and hotel chains and may allow you to transfer points for travel. This option may offer more benefits than trading in for cash back to use for your vacation. Even general travel cards offer rewards for travel and hotels when you book through a rewards website. Rewards may include travel credits, reimbursements, and redeeming with partner hotels.

Another option may be a co-branded credit card. Hotels, such as Mariott and Hyatt, offer exclusive deals like a free anniversary night on stays at their chains. This type of credit card may include entry into the hotel’s loyalty program, offering you more discounts and benefits. You can use a co-branded hotel credit card anywhere that accepts the type they are, such as Visa or Mastercard. Rewards are usually redeemable at the hotels associated with the card. Before you apply for a card, carefully consider the annual fees, interest rates, and associated costs. If you decide to open one, remember to pay off the balance in full each month to avoid fees and interest.

Hotel loyalty and reward programs may be two opportunities to earn discounts, but did you know you may have a tool already in your wallet? Membership cards may offer discounts on hotels, dining, shopping, and entertainment. Eligible groups may include:

- Students

- Alumni

- Teachers

- Emergency workers

- AAA membersAARP members

- AARP membersAARP members

- Military personnel (active duty and veterans)

- Government employees

Unlike hotel loyalty programs, discount programs may have a fee to join. For instance, AAA memberships include roadside assistance for your vehicle while offering discounts on travel. You may benefit from a membership if you frequently drive, travel long distances, or have trouble paying for roadside services without assistance. Research the cost and benefits of each discount program to weigh your options while staying within your travel budget. To learn more about membership discounts, contact any hotel or visit its website for complete details.

Consider the Time of Your Stay

When is the best time to book a hotel when planning a trip? Prices can change based on demand and time of year. Before deciding on dates, think about some alternatives that will make your vacation stress-free:

- Check price ranges, but don’t book right away. Compare the hotels to look for the best value.

- Determine when you’re taking your vacation. If you can get time off, you may consider extending your vacation to help save money. Some days of the week could be cheaper than others. Try to avoid booking a hotel on the weekends. Fridays, Saturdays, and Sundays are usually expensive due to leisure travelers. Booking on a weekday – specifically Mondays and Tuesdays – may have lower rates as business travel slows down.

- Think about traveling in the off-season when room prices are typically lower. For instance, winter resorts aren’t as busy in the summer. Booking on off-peak times may cost less and allow you to avoid crowds when traveling. Avoid booking on the weekend if you can’t plan an off-season vacation.

- Booking your hotel closer to your travel date may be cheaper, but be careful – hotel prices at the last minute could be more expensive due to high demand from a conference is taking place or if it’s a holiday, for example. You may decide booking in advance is the better option so that you won’t miss out on a hotel.

Choose Your Hotel Location Wisely

Staying in the city may cost more than staying in a hotel a few miles away. Research the area around where you wish to stay. You may save money by finding hotels within walking distance of any attractions so that you won’t have to spend money on extra travel. Any hotels far from any attractions will raise your transportation and parking costs.

Check Out Online Travel Agencies

Some online research can unveil major discounts or deals. Many booking sites and apps allow you to compare hotels’ rates, deals, and discounts. You can even read about the amenities and location, including attractions, dining, and more.

Some hotel booking sites include:

You may save more money when you bundle through an online travel agency. Websites like Expedia offer airfare, hotel, and rental car in a package. Maximize your savings by adding your loyalty or rewards program and frequent flyer account information to earn travel rewards.

When booking through an online travel agency, a commission is charged on each sale. The rates may be higher. Pay attention to the terms and conditions before you book. Booking websites and apps have restrictive policies, such as guest cancellations and automatic room reselling.

Open a Savings Account Today

If you're saving for your next vacation, stop by any of our branches and open a Hometown Savings account today!

It's a great savings account for those who don't want to worry about high, required minimum balances. You must have a $100 monthly minimum balance. You'll also receive access to eStatements, online banking, mobile banking, and more!

Make the switch to Adirondack Bank today! Our dedicated staff is ready to help you choose the products and services that fit you best!

The information in this article was obtained from various sources not associated with Adirondack Bank. While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. Adirondack Bank is not responsible for, and does not endorse or approve, either implicitly or explicitly, the information provided or the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. Adirondack Bank makes no guarantees of results from use of this information.