Unlock Your Bank's Routing Number: The Key to Successful Banking

You must provide routing and account number every time you make a financial transaction. Both are mandatory in most instances.

At the bottom of your check, there is a long string of numbers. This number is important for setting up direct deposit or receiving your tax refund. Ask yourself:

- What is a routing number?

- What does the number look like?

- How do you use a routing number?

To understand how transactions work, here’s an explanation of a routing number.

What Is a Routing Number?

Just like you have a Social Security number or a Taxpayer Identification Number (TIN) for businesses, banks have a specific nine-digit identification number. This code is unique to every institution. It leads to less confusion among financial institutions with similar names and less widespread transaction errors.

Some big banks may have more than one routing number. Banks may also have separate routing numbers for different transactions, such as:

- Checks

- Wire transfers

- Electronic or Automated Clearing House (ACH) transactions

Some banks may use the same routing number for all transactions. If you’re looking for the routing number, your bank may ask for the type of transaction or account.

What Does a Routing Number Look Like?

The number has three markers:

- The Federal Reserve Routing Symbol is the first four digits. Banks use routing numbers starting with 01.

- The second four digits are the American Bankers Association (ABA) bank identifier. This code represents your specific bank.

- The final number, called a check digit, prevents transaction errors.

For over a century, all financial institutions in the U.S. have been using this system. American Bankers Association created this method, called ABA routing numbers. This streamlined process helped move money from one financial institution to another.

When Would You Need a Routing Number?

Some situations in which you may need to provide the routing number are:

- Paying a bill online.

- Writing a check to send money from your checking account to someone else.

- Setting up direct deposit for paychecks from your new job, Social Security, or other government benefits.

- Receiving deposits from your tax returns.

- Setting up automatic online bill payment.

- Processing a check.

- Reordering checks.

- Transferring money between accounts with different banks.

Some peer-to-peer payment services, such as Zelle®, don’t require a routing number to send and receive money. If your financial institution offers Zelle®, it’s available in your mobile banking app and online banking. If your financial institution doesn’t offer the service, all you need to enroll in the Zelle® app is an email address or a U.S. mobile phone number and a debit card to send money to friends and family. Other payment services, such as Venmo and PayPal, may require you to link your bank account information.

How Is a Routing Number Different from an Account Number?

You don’t want to get a routing number mixed up with an account number. Even though you often use these simultaneously during financial transactions, they are distinctly different numbers.

We already defined a routing number: the code used to identify a bank or credit union. Your financial institution stores your funds under a specific account number. This number distinguishes your records from other customers and accounts you may have at the same place.

An account number – between eight and 12 digits – identifies your account. If you have two accounts at the same bank, the routing number may be the same. The account numbers are different.

You can find the routing number anywhere online, but remember your account number is special to you. Guard your account like you would your Social Security number or Personal Identification Number (PIN).

Where Can You Find a Routing Number?

Routing numbers are typically easy to locate. If you have an active checking account, the easiest way is to look at your paper checkbook.

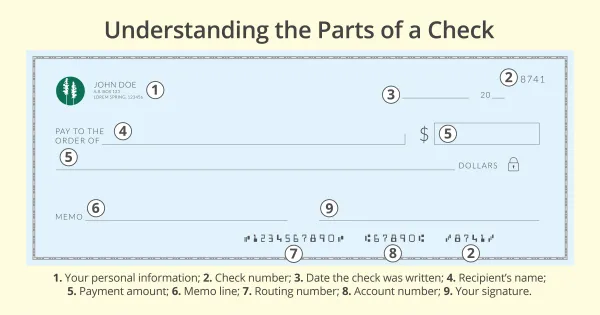

The nine-digit code on the bottom-left corner of every check is the financial institution's routing number. The second number, which is to the right of the routing number, is your personal account number. The check number is last. It makes up the magnetic ink character recognition line (MICR).

If you don’t have a personal check in front of you, you may also find the routing number in these places:

- Your bank statement.

- Your bank's website, online banking, or mobile banking app.

- Through your bank's customer service.

- The ABA routing number lookup. Make sure you’re looking at the correct institution.

If you have any questions about locating or using a routing or account number, feel free to contact us. We're available by phone, email, and online chat.

Open an Account Today!

If you're looking to open an Adirondack Bank checking or savings account, our dedicated staff is happy to help!

We offer you great options to match your account with your unique lifestyle. Compare our checking and savings accounts to help you choose what's best for you.

Visit any branch to open an account today! We'll take the time to understand your needs to help you find the products and services that are right for you.

The information in this article was obtained from various sources not associated with Adirondack Bank. While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. Adirondack Bank is not responsible for, and does not endorse or approve, either implicitly or explicitly, the information provided or the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. Adirondack Bank makes no guarantees of results from use of this information.